We believe that regardless of socioeconomic status, all of our neighbors should have an affordable home. But what does affordable really mean? Depending who is talking, it can mean something different.

For many people, affordable housing is the basic understanding of people living in housing they can afford. It is seen as an umbrella that covers a range of options from income-restricted housing, Section 8, to apartments and single-family homes. The simplest definition used by the federal government is, “affordable housing is generally defined as housing in which the occupant is paying no more than 30 percent of gross income for housing costs.” The costs include mortgage, rent, insurance, property taxes, utilities, and homeowner association fees. This means, no matter if your household annual income is $30K or $300K, no more than 30% of that should go to your housing costs.

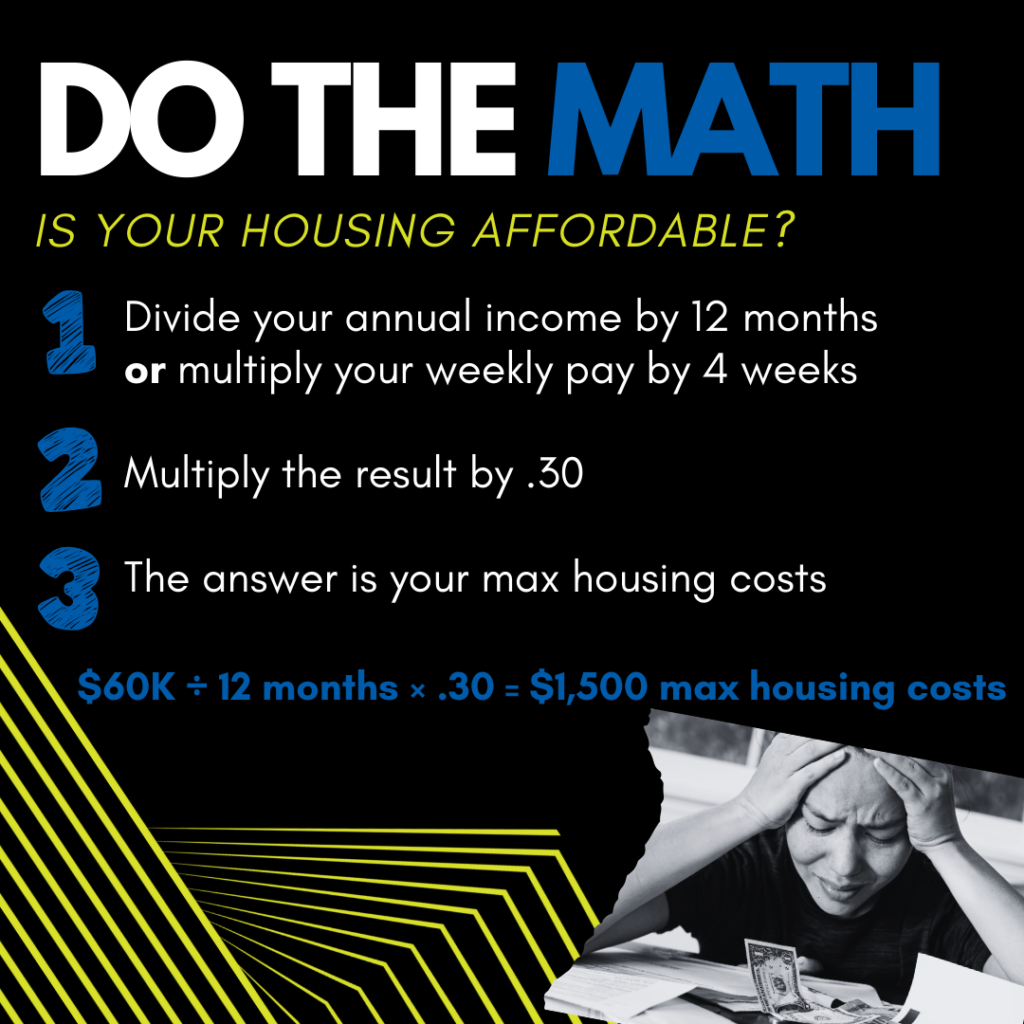

Do the math.

- Step 1: Divide your annual household income by 12 months or multiply your weekly pay by 4 weeks. The answer is your monthly household income.

- Step 2: Multiply your household income by 30%. The answer is the total amount that your household expenses should not exceed.

Example: $60K annual household income ÷ 12 months = $5K monthly household income. $5K × .30 = $1,500 monthly housing cost maximum.

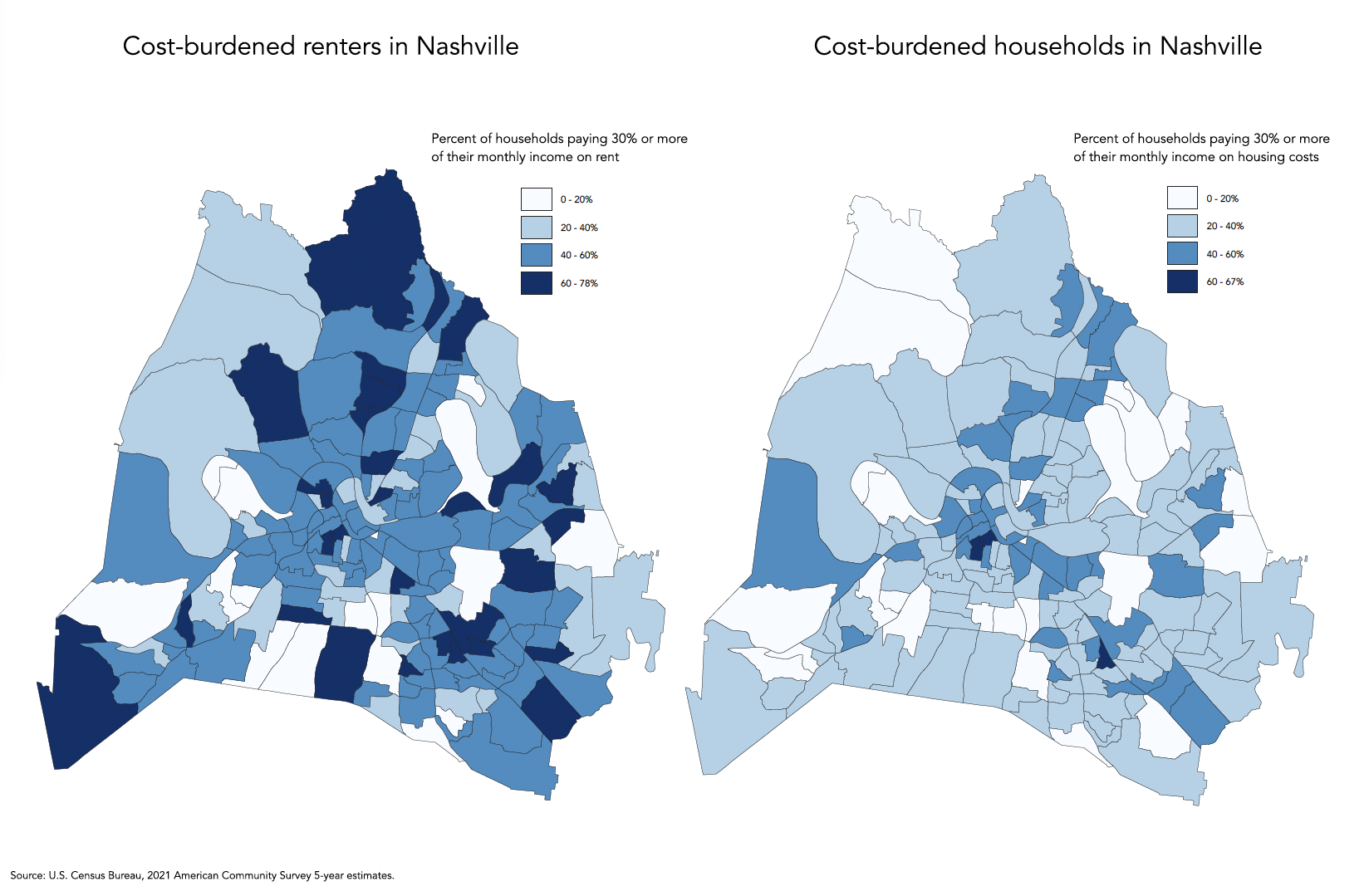

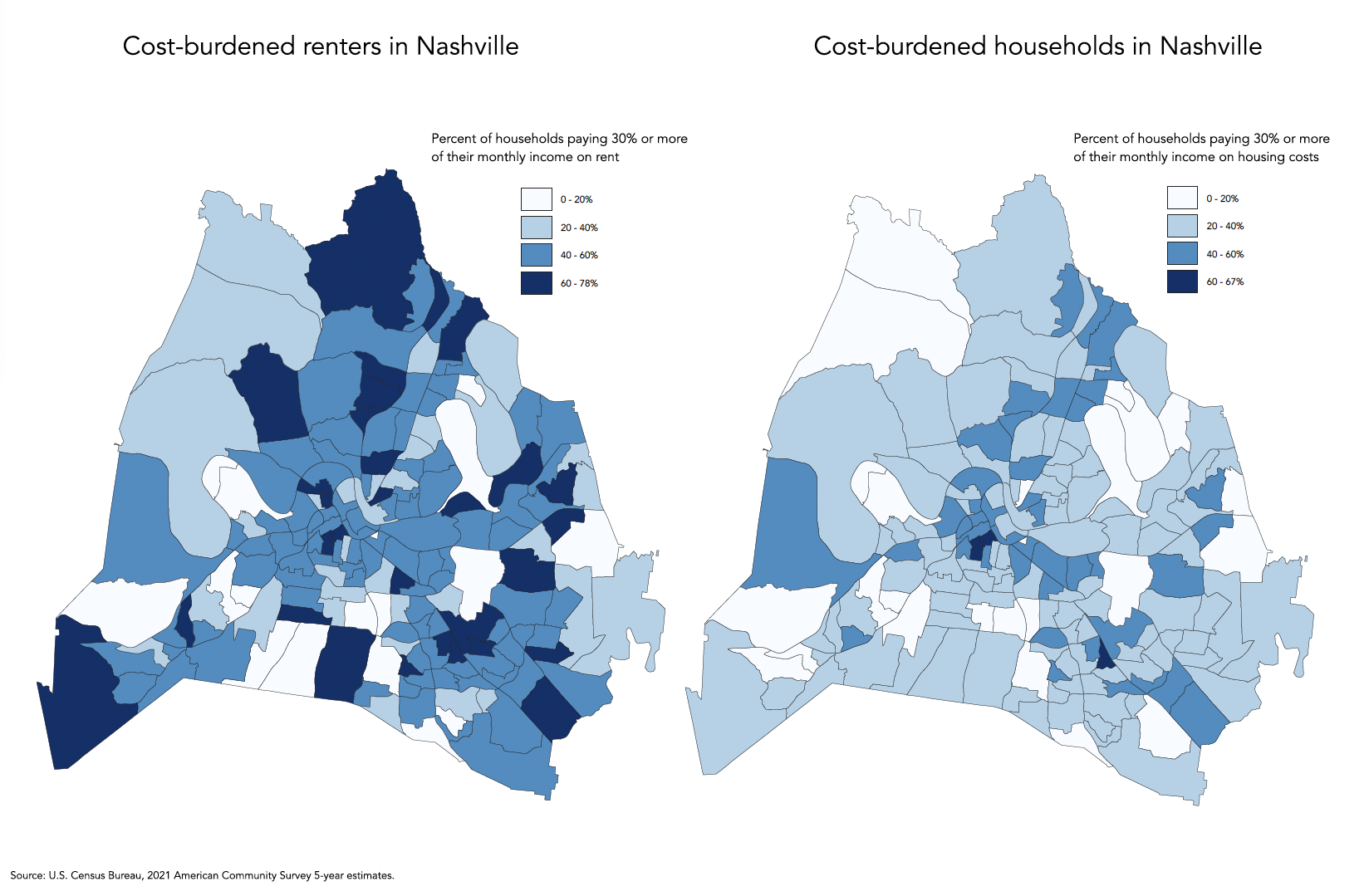

What does it mean if a household’s housing costs exceed 30%? Housing costs exceeding 30% mean the household is cost-burdened and 50% means extremely cost-burdened. Being cost-burdened causes families to make tough decisions in their basic needs including groceries, health and wellness, and transportation. It doesn’t stop there. The impact extends to families who are forced to move away from their community to find housing in less expensive areas. While housing costs go down, the time spent commuting increases and transportation costs increase – especially when there is a lack of sufficient public transportation.

The US Department of Housing and Urban Development (HUD) also uses the area median income (AMI) to measure affordable housing and community needs based on socioeconomic data such as location, education, and poverty indicators. HUD also uses AMI to differentiate between affordable housing (0-80% AMI) and workforce housing (81-120% AMI). According to the Metro Nashville Human Relations Commission, nearly 70% of Nashville residents fall into affordable or workforce housing.

To create housing that actually serves the needs of lower income residents, we have to target lower AMI percentages that match wages or use a metric that better reflects the neighborhood in question. Often, advocates and planners prefer to base affordable housing on 0-60% AMI and workforce housing as 61-120% AMI to better reflect the need and reality.

Separately, HUD’s Fair Market Rent Area annual calculation is used by entities using HUD funds to set rents. The Nashville-Davidson-Franklin- Murfreesboro Fair Market Area includes 10 counties: Cannon, Cheatham, Davidson, Dickson, Robertson, Rutherford, Sumner, Trousdale, Williamson, and Wilson. The 10 counties’ income levels can significantly differ which skews the numbers and concept of affordability. Williamson County is the richest county in Tennessee, when factored in with counties that do not make the same or similar amounts, it increases the median income for the whole area. This disenfranchises and dismisses lower income areas in Metro Nashville.

What are we doing about it? Stand Up Nashville fought hard and won affordable housing provisions as part of the development at the Nashville Fairgrounds next to GEODIS Park.

- 12% of units will be designated for 60% AMI

- 4% of units will be designated for 61-80% AMI

- 4% of units will be designated for 81-120% AMI

- 20% of affordable housing units will be three-bedroom

- 20% of workforce housing units aim to be three-bedroom

We’re proud of the work that we’ve accomplished so far with supporters, volunteers, and donors like you. Together, we will continue to champion the housing needs of our neighbors and ourselves…did you do the math?

What can you do about it? Use your voice! The Metro Housing Division is submitting an application to the US Department of Housing and Urban Development for the Pathways to Removing Obstacles to Housing (PRO Housing) grant. The application is available for review and public comment through Tuesday, October 17 at 11pm.

Lastly, please take a moment to complete the affordable housing calculation to determine your own affordable housing status and respond to let us know:

- Are you at or below your monthly housing cost maximum, cost-burdened, or extremely cost-burdened?

- What does the answer make you think about affordable housing?

We appreciate your engagement and will not use your name with your response.